mHealth has gained significant traction and investment from many participants, as it has evolved to substantively-funded business ventures aimed at reaching broad consumer segments. Research reports by Accenture suggest that mHealth products and services can help meet two important goals: provide high quality care and reduce costs, particularly of managing chronic diseases.

New healthcare funding (in particular, emerging reimbursement policies), the pervasiveness of mobile technologies and the current state of the health market make this an interesting time for the life science industry. Should companies make significant investments and establish leadership positions now? Or, should they wait and see how policies, technologies and stakeholders’ strategies evolve? Which options make the most sense given the critical and necessary role of pharmaceutical companies in improving patient health and their need to create new value streams for key stakeholders?

Why mHealth Now?

Accenture finds that several factors are converging to position mHealth into mainstream healthcare. Primarily, the need for the treatment of chronic diseases by a rapidly aging population is at a high. In the U.S., 86 percent of people over the age of 65 suffer from at least one chronic ailment (diabetes, cardiovascular disease, chronic obstructive pulmonary disease, asthma, cancer, or arthritis) with the majority having more than one.1 Collectively and globally, the treatment of these diseases account for about three-fourths of healthcare expenditure, leading to a strain on financial and medical resources.

Secondly, the shortcomings of episodic treatment and event-driven reimbursement are well known. Patients delay seeing a healthcare professional until the symptoms severely impact their quality of life and/or limit treatment options making the use of more costly and more invasive treatment necessary. Recent studies have also highlighted sporadic patient compliance as a key concern. In a UCLA study of patients discharged from a hospital, reports reveal that 73 percent failed to use at least one prescribed medication, and only 32 percent had taken all medications prescribed, resulting in “delayed recoveries, complications and costly readmissions.”

Similarly, relying on patients with chronic diseases such as diabetes to assess whether treatment adjustment is necessary can be unproductive. A recent New England Journal of Medicine (NEJM) article found significantly improved glycemic control in adults with type 1 diabetes who used devices vs. patients who used traditional home monitoring and reporting. These results were found to be similar to a trial by Nationwide Children’s Hospital in Ohio, which sent text reminders to teenage patients’ cell phones to take their medications. The result was a drop in the A1C levels from an average of 11 percent to 9 percent in the first three months.3 Accordingly, mHealth addresses some of the outcome and cost issues related to traditional and episodic treatment to improve patient health.

The Evolution of mHealth

Accenture asserts that mHealth will evolve at different rates and through different paths, depending on a country’s healthcare landscape and the scope of the mHealth solution. For example, Accenture states that the United States is several years away from adopting comprehensive solutions but this timeframe will be easier to traverse in comparison to Western Europe due to private payer dynamics, political agendas and healthcare economic factors. We envision immediate adoption and rapid growth of narrowly-focused mHealth solutions (e.g., Web and mobile-enabled drug adherence solutions) due to ease of payment and limited barriers to usage.

Even as mHealth products and services continue to evolve, it is becoming clear that most will fall into two distinct categories: 1) stand-alone products and services, or 2) comprehensive solutions. Stand-alone solutions and devices are focused on specific functions, diseases or data collection such as Glucose monitors for diabetics or ingestible ‘smart pills’ that track medication compliance. In contrast, comprehensive mHealth solutions have broader healthcare delivery applications and will include an extensive network of stakeholders to support and provide care.

Stand-alone products or services To date, much of the innovation and investment in mHealth relates to stand-alone solutions because it is easier to bring a discreet product or service developed for an identifiable target segment to the market. The value and benefits would be easier to explain and the implementation can be streamlined. Current examples of stand-alone mHealth products or services include, but are not limited to:

• A portable electrocardiogram heart monitoring device for at-home use that measures only 4” x 3” and weighs 3.5 oz.;

• A smart shirt with embedded sensors continuously monitors more than 30 physiological signs, including respiration, posture and cardiac function;

• ‘Home cams’ or other inexpensive and smart environmental sensors (e.g., motion/activity sensors, temperature sensors, webcams) that monitor and calibrate the health and safety of patients within their home environments.

Comprehensive solutions

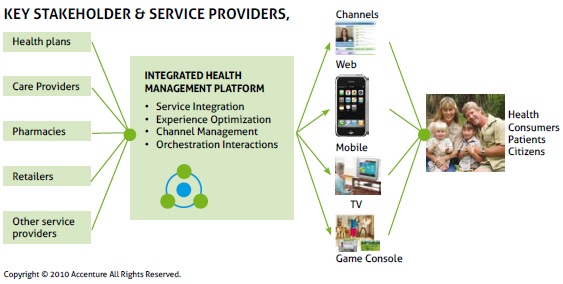

In contrast to stand-alone offerings, comprehensive solutions provide end-to-end services that encompass patient education, diagnostic services, as well as ongoing disease management and treatment. While the value delivered to patients from comprehensive solutions can be substantial, developing such solutions requires intensive effort and collaboration.

There are some organizations such as the Veteran Health Administration (VHA) that can control end-to-end service for a captive population (i.e., military veterans with VHA health plans), but the development and delivery of highly comprehensive solutions will require a multi-player alliance of independent companies, each bringing specialized medical technology, or management capabilities and assets. Consequently, the development and testing of comprehensive solutions becomes more complex.

Nonetheless, there have been promising collaborations to deliver comprehensive solutions. Industry reports show insurance providers are becoming active participants in the development of comprehensive mHealth services, with WellPoint, Humana, Aetna and Highmark launching initiatives that enable remote and/or mobile monitoring of symptoms for a variety of conditions and diseases.

Some of these collaborations are between unlikely partners. According to news reports, Best Buy, the consumer electronics giant, was chosen by Microsoft to help advance Microsoft’s HealthVault medical record initiative. Best Buy sells wireless enabled devices that make the tracking and communication of records easier. Similar news reports show that Significa Insurance Group and AllOne Health have a comparable collaboration; England’s National Health Service has launched remote monitoring of chronic obstructive pulmonary disease patients; and the telecommunications company Orange is also testing mHealth services.

The results of mHealth initiatives are encouraging, whether focused on a specific disease or patient segments. The New England Healthcare Institute found that remote monitoring for heart failure patients reduced the re-admittance rate by 32 percent following a heart failure hospitalization, resulting in net savings of more than $1,861 per patient.4 This result was mirrored in a meta-analysis of remote heart monitoring studies involving 9,500 patients with chronic heart failure compiled by the Cochrane Review which showed a reduction in mortality for heart patients using remote follow-up monitoring.

Given that comprehensive mHealth requires a significant information technology infrastructure and can involve development of new devices or products, companies known for their engineering like Bosch, Intel, and Philips have all begun investing in mHealth solutions, sometimes partnering with provider groups to test offerings. The momentum behind mHealth is accelerating in part because these trials and pilots have shown positive results and improvements in patient care.

Challenges with the adoption of mHealth

As with any new technology and capability, adopting mHealth is not without its challenges. A few of the more pressing challenges are outlined below:

While innovation on the technical front is advancing, the marketplace moves more cautiously, stymied by a healthcare business model where the interests of medical practitioners, health insurers, and patients are often out of sync. Remote and in-home monitoring can threaten traditional revenue streams of practitioners and institutions. What’s more, health insurers are holding the line on new treatment methods until they are proven medically effective and cost effective. This has created a Catch-22 situation where new technologies won’t be funded until proven, and can’t be proven until funded. The other issue is the consistent reimbursement and payment policy. This will vary across markets and systems, yet ideally should be consistent to support larger scale and basic availability, whether someone is treated by Kaiser Healthcare or at the Mayo Clinic or through a local network.

Incompatible technology standards

There are also unresolved technical issues with respect to standards, security, privacy, and other regulatory matters. The industry’s slow progress in agreeing to standards is problematic as comprehensive solutions typically call for diverse devices and systems to work together to address the unique and complex needs of an individual patient. In an Accenture in-depth study of mHealth, an industry leader observed that there are “device class standards or end-to-end standards. Every network requires individual certification. There are no standards for Wi-Fi or the wireless personal area network. This fragmentation poses significant problems.”

Prohibitive regulatory restrictions

Privacy is also a concern of patients and regulators. While social networking sites like PatientsLikeMe or Facebook fan pages for medications and brands encourage users to share medical details, that disclosure is voluntary. User-managed repositories for medical records such as Microsoft HealthVault have had some success, but Health Insurance Privacy and Portability Act regulations in the US are still barriers to efficient exchange of health information among networks of third parties.

All of these challenges can be addressed with concerted efforts. Networks of mHealth providers that are flexible, well-funded and clear about the added value they deliver in improving care will be most able to gain regulatory approval and market traction to overcome these barriers.

Conclusion

References:

Centers for Disease Control and Prevention. National Health Interview Survey.2008.

www.cdc.gov/nchs/health_policy/adult_chronic_conditions.htm

Beers MH, Sliwkowski J, Brooks J. Compliance with medication orders among the elderly after hospital discharge. Hospital Formulary. 1992; (27(7): 720-724.

MobiHealthNews. Texting improves Type 1 Diabetes Adherence. August 10,2010.

New England Healthcare Institute. Remote Physiological Monitoring: Innovation in the Management of Health Failure. July 2004.